What's my home worth?

Sent

What's my home worth?

Sent

Marcos Flores

Let's Find Your Next Place

You DO NOT Need 20% Down To Buy Your Home NOW!

June 25, 2018

The Aspiring Home Buyers Profile from the National Association of Realtors (NAR) found that the American public is still somewhat confused about what is required to qualify for a home mortgage loan in today’s housing market. The results of the survey show that the main reason why non-homeowners do not own their own homes is because they believe that they cannot afford them.

This brings us to two major misconceptions that we want to address today.

1. Down Payment

A recent survey by Laurel Road, the National Online Lender and FDIC-Insured Bank, revealed that consumers overestimate the down payment funds needed to qualify for a home loan.

According to the survey, 53% of Americans who plan to buy or have already bought a home admit to their concerns about their ability to afford a home in the current market. In addition, 46% are currently unfamiliar with alternative down payment options, and 46% of millennials do not feel confident that they could currently afford a 20% down payment.

What these people don’t realize, however, is that there are many loans written with down payments of 3% or less.

Many renters may actually be able to enter the housing market sooner than they ever imagined with new programs that have emerged allowing less cash out of pocket.

2. FICO®Scores

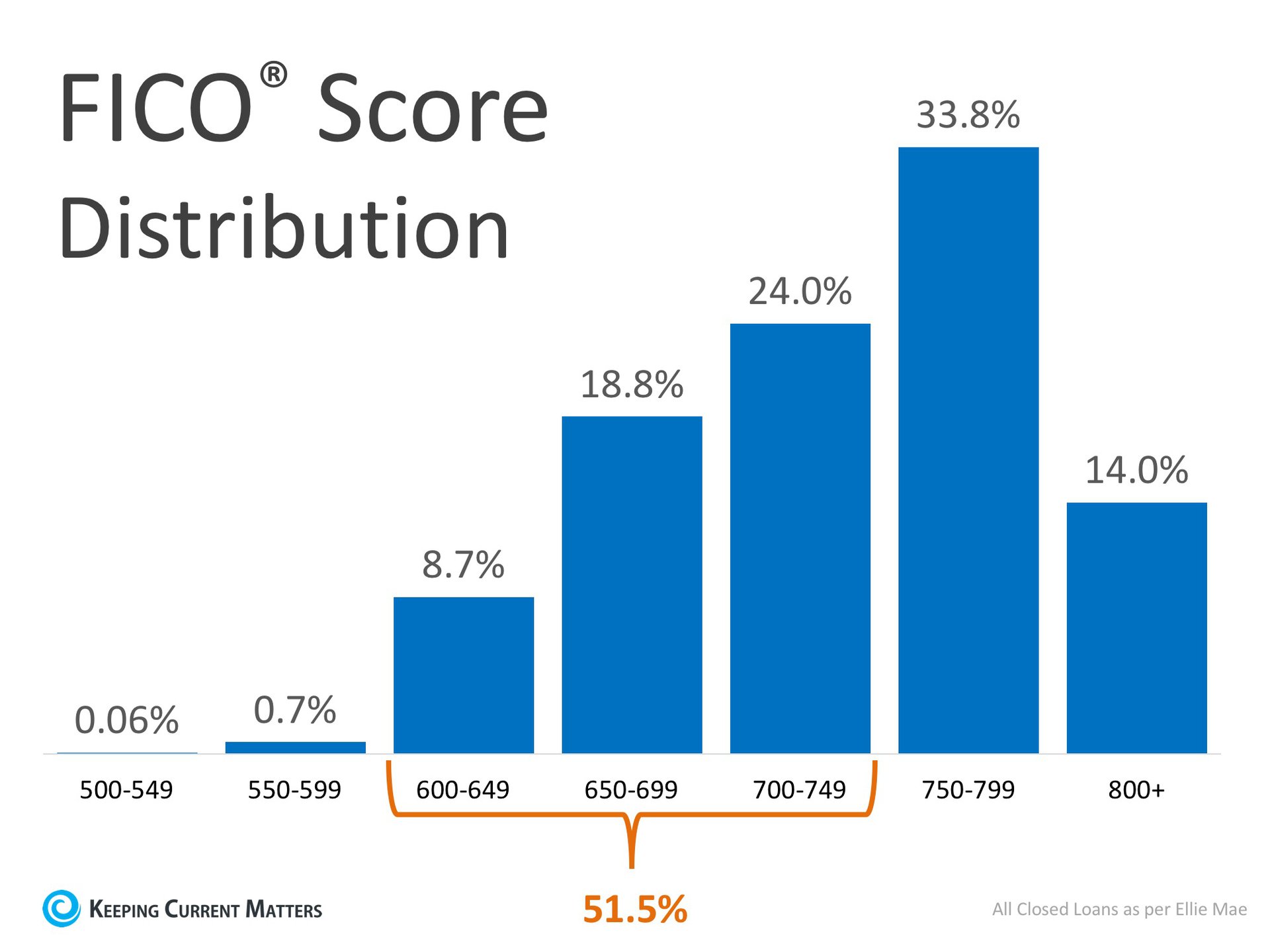

An Ipsos survey revealed that 62% of respondents believe they need excellent credit to buy a home, with 43% thinking a “good credit score” is over 780. In actuality, the average FICO® scores for approved conventional and FHA mortgages are much lower.

The average conventional loan closed in May had a credit score of 753, while FHA mortgages closed with an average score of 676. The average across all loans closed in May was 724. The chart below shows the distribution of FICO® Scores for all loans approved in May.

Bottom Line

If you are a prospective buyer who is ‘ready’ and ‘willing’ to act now, but you are not sure if you are ‘able’ to, sit down with a professional who can help you understand your true options today.

Tags: